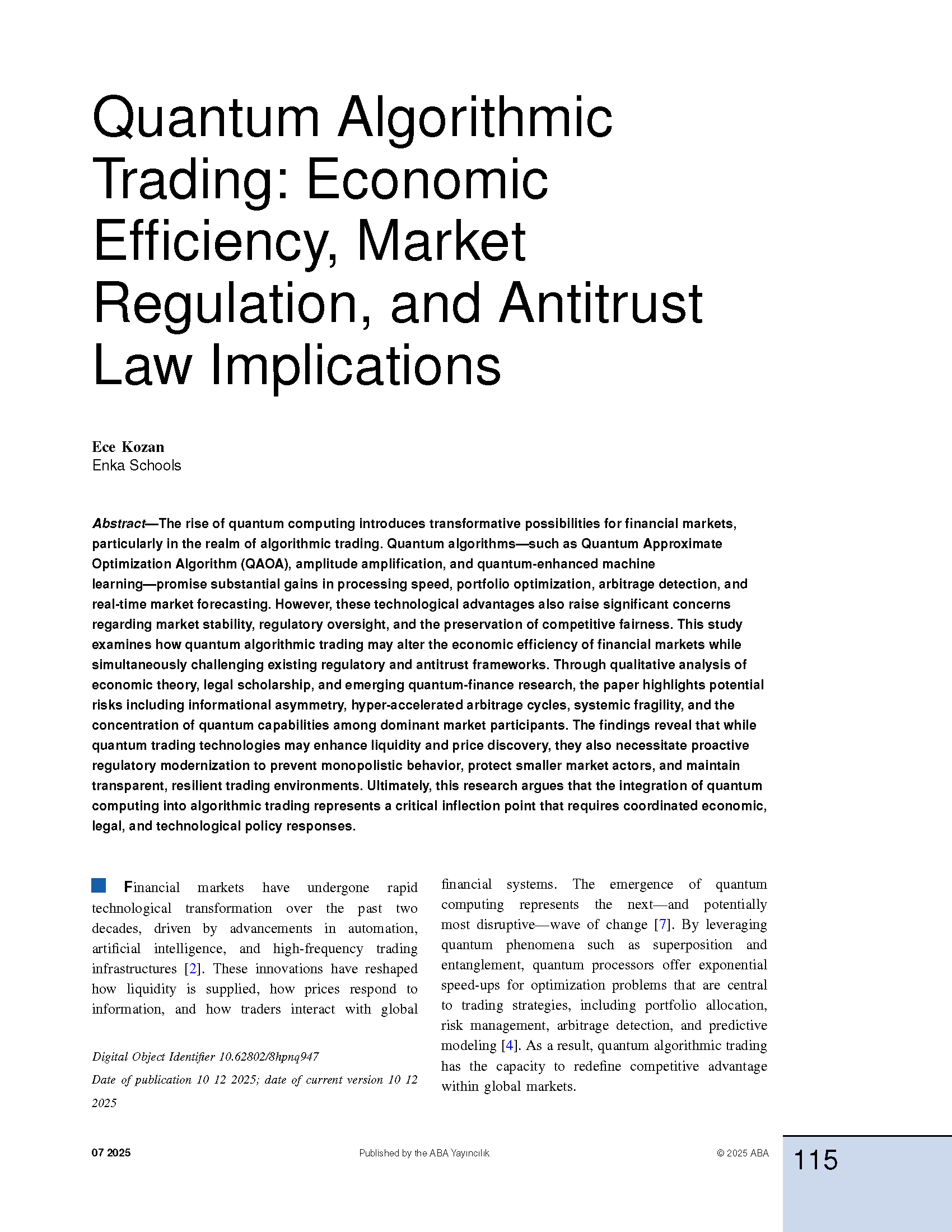

Quantum Algorithmic Trading: Economic Efficiency, Market Regulation, and Antitrust Law Implications

DOI:

https://doi.org/10.62802/8hpnq947Keywords:

quantum computing, algorithmic trading, market efficiency, financial regulation, antitrust law, quantum optimization, systemic risk, digital marketsAbstract

The rise of quantum computing introduces transformative possibilities for financial markets, particularly in the realm of algorithmic trading. Quantum algorithms—such as Quantum Approximate Optimization Algorithm (QAOA), amplitude amplification, and quantum-enhanced machine learning—promise substantial gains in processing speed, portfolio optimization, arbitrage detection, and real-time market forecasting. However, these technological advantages also raise significant concerns regarding market stability, regulatory oversight, and the preservation of competitive fairness. This study examines how quantum algorithmic trading may alter the economic efficiency of financial markets while simultaneously challenging existing regulatory and antitrust frameworks. Through qualitative analysis of economic theory, legal scholarship, and emerging quantum-finance research, the paper highlights potential risks including informational asymmetry, hyper-accelerated arbitrage cycles, systemic fragility, and the concentration of quantum capabilities among dominant market participants. The findings reveal that while quantum trading technologies may enhance liquidity and price discovery, they also necessitate proactive regulatory modernization to prevent monopolistic behavior, protect smaller market actors, and maintain transparent, resilient trading environments. Ultimately, this research argues that the integration of quantum computing into algorithmic trading represents a critical inflection point that requires coordinated economic, legal, and technological policy responses.

References

Aggrawal, N., & Pandey, A. (2025). Leveraging Internet of Behavior analytics to enhance retail stock trading: A strategic framework for optimized trading and market dynamics. In Mapping Human Data and Behavior With the Internet of Behavior (IoB) (pp. 435-496). IGI Global Scientific Publishing.

Balaji, K. (2025). Revolutionizing High-Frequency Trading: The Impacts of Financial Technology and Data Science Innovations. Machine Learning and Modeling Techniques in Financial Data Science, 103-124.

Kumar, M. A., Mohammed, A., Marimuthu, M., & Sundaravadivazhagan, B. (2025). Exploring the Entrepreneurial Opportunities Arising from AI‐Driven Quantum Computing Advancements. Quantum Computing and Artificial Intelligence: The Industry Use Cases, 497-522.

Lamichhane, P., & Rawat, D. B. (2025). Quantum Machine Learning: Recent Advances, Challenges and Perspectives. IEEE Access.

Nayak, S. (2025). Synergizing AI and Quantum Computing to Revolutionize Financial Crime Detection.

Pippas, N., Ludvig, E. A., & Turkay, C. (2025). The Evolution of Reinforcement Learning in Quantitative Finance: A Survey. ACM Computing Surveys, 57(11), 1-51.

Yavuz, B. (2025). Transformative impact of quantum computing on social sciences: Digitizing social sciences and their societal implications. In Future of digital technology and AI in social sectors (pp. 93-120). IGI Global.

Zhou, J. (2025). Quantum finance: Exploring the implications of quantum computing on financial models. Computational Economics, 1-30.